The global financial crisis presented many African countries with an opportunity to rethink their development strategies, models and policies to meet development priorities as well as develop alternative policy prescriptions. Some of these prescriptions are a distinct departure from development models that have been tried and tested in the past. The financial crisis threatened to undo the positive performance of economies in Africa in recent years and many countries such as Kenya have looked at fiscal policy reforms as a mechanism which could address the challenges brought about by the crisis. In 2013, the International Monetary Fund (IMF) projected Kenya’s economic growth for 2014 as 5.3%. In April 2017, it projected that the economy would grow by 5.3% but later revised the projected growth to 5% on account of a charged political environment, drought, weak credit growth, security concerns and the pick-up in oil prices.

According to the Parliament Budget Office (PBO) in Kenya, the economy performed well in the first quarter of 2018, growing by 5.7%, buoyed by improved performance of the agriculture and manufacturing sectors (See Table 1 for real GDP growth). In the 2018 Budget Policy Statement, the Kenyan National Treasury projects that the economy will improve to 3.7% in 2018 up from 3.6% in 2017. In the macroeconomic framework underpinning the 2018/19 budget, the Kenya National Treasury projects that the economy will grow by 6.0% in 2018; a significant increase from the 4.9 % economic growth experienced in 2017 (Figure 1). This is expected to be fueled by output from agriculture, recovery of the tourism sector, strong private sector investment, completion of key public projects in road, rail and energy generation.

Figure 1: Trend in Kenya’s Economic Growth (2013 -2017)

Source: Kenya National Bureau of Statistics

Table 1: Real GDP growth rates for selected sectors (Percentage)

| Sector | 2015 | 2016

|

2017 | 2018 | |||

| Q1 | Q2 | Q1 | Q2 | Q1 | Q2 | Q1 | |

| Agriculture | 7.8 | 4.4 | 4.5 | 7.7 | 1.0 | 0.8 | 5.2 |

| Mining | 9.1 | 13.8 | 5.5 | 9.1 | 7.1 | 6.0 | 4.5 |

| Manufacturing | 2.9 | 3.0 | 1.2 | 4.6 | 1.3 | -0.2 | 2.3 |

| Electricity & Water | 9.8 | 11.9 | 10.6 | 11.8 | 6.1 | 6.0 | 5.1 |

| Construction | 12.9 | 12.2 | 9.2 | 7.2 | 8.2 | 9.5 | 7.2 |

| Wholesale & Retail | 5.5 | 4.8 | 3.5 | 2.1 | 4.8 | 5.4 | 6.3 |

| Accommodation &

Restaurant |

10.5 | -1.9 | 8.2 | 14.1 | 24.5 | 12.6 | 13.5 |

| Transport & Storage | 8.3 | 9.0 | 8.8 | 6.9 | 9.4 | 8.0 | 7.1 |

| Information & Communication | 8.9 | 8.3 | 10.6 | 8.9 | 12.5 | 10.8 | 12.0 |

| Financial & Insurance | 10.0 | 8.7 | 8.8 | 8.5 | 5.3 | 3.5 | 2.6 |

| Real Estate | 6.3 | 6.9 | 9.6 | 8.9 | 6.1 | 6.0 | 6.8 |

| Education | 4.4 | 4.7 | 5.8 | 5.3 | 5.7 | 5.9 | 6.7 |

| Health | 5.2 | 6.1 | 4.1 | 5.2 | 4.7 | 6.7 | 5.7 |

| Overall GDP | 5.7 | 5.5 | 5.4 | 6.3 | 4.8 | 4.7 | 5.7 |

Source: Kenya National Bureau of Statistics

The Parliamentary Budget Office (PBO) is however of the view that the economic growth projections by the National Treasury are unlikely to be achieved owing to, unpredictability in development spending by most counties in the country and secondly, poor implementation of projects across all sectors, particularly in manufacturing which may affect ongoing infrastructure investments. According to PBO, if we were to take into consideration recent economic developments, such as, interest rate capping law, rebasing of the GDP, the state of insecurity and its impact on key sectors like tourism, wholesale and retail trade, manufacturing and the level of investment, coupled with Kenya’s reliance on rain fed agriculture and low absorption of development expenditure by both the National and County Governments, it projects that the economy will grow by 5.5% and not 6.0 %.

They base this scenario on a sustained fiscal expansion by government as it continues to invest in mega infrastructure projects such as roads and energy projects; a somewhat stable inflation and exchange rates in the first half of 2018 (food inflation has declined due to sufficient food production but fuel inflation has been on the rise due to increased fuel prices locally and internationally), a stable political environment and the continued good performance in the ICT sector and services, that have emerged as some of the key drivers of higher growth following the rebasing of GDP.

Kenya’s Fiscal Policy

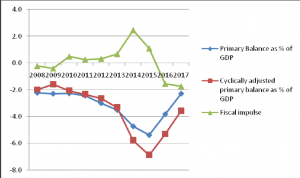

Fiscal policy is an indicator of the financial policies being implemented by a country. It involves the use of government incentives to address the amount of money in circulation. There are normally two types of fiscal policies. These are expansionary and contractionary fiscal policies. Fiscal policy is contractionary when the fiscal impulse is negative, and it is expansionary when the fiscal impulse is positive. Government spending, taxation and borrowing are the three major instruments of fiscal policy. Over the years Kenya has experienced an expansionary fiscal policy as indicated by the recent reduction of the Central Bank policy rate to 9.0% in a bid to stimulate credit expansion to the private sector and as shown in Figure 2, there has also been a gradual increase in the primary deficit (that is balance before interest payments). The cyclically adjusted primary balance, which is adjusted for regular shocks in the economy such as employment and inflation, has been worsening over the years. Going forward, given the projected improvement in Kenya’s economic growth, both the primary balance and the cyclically adjusted primary balance may improve but this will be a likely result of a contractionary fiscal policy as shown by the declining fiscal impulse.

Figure 2: Fiscal impulse, primary balance and cyclically adjusted primary balance

Source: Parliamentary Budget Office, 2015

While it is true that the fiscal framework under 2018 Budget Policy Statement (BPS) is largely different from previous ones in terms of policy outlook, it has continued with the broad strategic priorities and policy goals. Additionally, the fiscal responsibility principles and financial objectives over the medium term in the 2018 BPS are identical to those in the 2017 BPS yet up to now they have not been adhered to. For instance, the government of Kenya has always advanced and encouraged reduced timelines for procuring goods in order to purchase them competitively in the market, but up to now the timelines for purchasing goods has never reduced even with the introduction of e-procurement.

The lack of adherence to the fiscal framework over the medium term makes the macroeconomic outlook unpredictable, hence not mitigating any fiscal risks. Macroeconomic assumptions and public debt remain unchallenged risks to the economy of Kenya. Unexpected changes in the macroeconomic variables create risks to both revenue and expenditure projections. The sources of this risk include reduction in real GDP, inflation instability, exchange rate volatility, and volatility of commodity prices on imports. With respect to public debt, mega investment in infrastructure and related projects require huge financial investment that cannot be adequately funded through the revenue generated locally. To plug the budget deficits created by the execution of these projects, the government resorts to debt financing, increasing debt levels both foreign and domestic. This also comes with debt related costs and payment of interests which shrinks the funding for other essential programs and services needed by the citizens.

A review of previous Budget Policy Statements clearly indicates lack of a clear fiscal consolidation strategy that has just continued over the years. For example, in the 2014 BPS the GDP growth projection for 2015/16 was projected to be 6.3 percent while the 2015 BPS or the same year was set at 7.0 percent. Moreover the primary budget balance was moved from -3.6 to -4.9 percent over the same period. Factoring in PBO’s estimations, for fiscal sustainability to be achieved, debt to GDP has to slow down at a faster rate than what is provided for in Budget Policy Statements.

Table 2: Selected Main Macroeconomic Indicators

| Real GDP | Primary Budget Balance | Exports, value goods and services | ||

| BPS, 2014

(After rebasing) |

2015/16 | 6.3% | -3.6% | 21.1% |

| 2016/17 | 6.7% | -2.4% | 21.5% | |

| BPS, 2015 | 2015/16 | 7.0% | -4.9% | 20.5% |

| 2016/17 | 7.1% | -2.9% | 20.5% | |

| 2017/18 | 7.0% | -1.6% | 20.5% |

Source: National Treasury

The main issues of concern that can be highlighted are that, first and foremost, the fiscal framework is usually hinged on high GDP growth rates which more often than not are unattainable. As a result of this, the government tends to introduce supplementary budgets during the year which are disruptive. Secondly, given the fact that the fiscal deficit is spiralling upwards, there is an urgent need for fiscal consolidation. Fiscal consolidation improves the primary balance, which directly lowers the amount of funds the government has to borrow, and hence the level of debt.

Conclusion and Recommendations

Kenya’s economy is highly dependent on its natural resource base. The effect of this is two- fold, first, that the country is highly vulnerable to climate change, and second, the country’s Vision 2030 goal of creating a globally competitive and prosperous nation with a high quality of life is threatened. Many policy analysts have argued that the issue of climate change cannot be addressed without transforming a country’s economy. They further argue that an economy can be effectively transformed by reforming fiscal policies in such a way as to promote green investments across various sectors.

Some of the reforms that Kenya can undertake in an effort to promote sustainable development include:

- Removal of inefficient and environmentally harmful subsidies

- Energy subsidy reforms – removing both direct and indirect subsidies from the failure to charge for environmental externalities could generate significant revenues for fiscal consolidation, lowering other burdensome taxes, or funding green investments.

- Well targeted “green fiscal reforms” – these can be used to discourage excessive energy consumption and generate additional resources for green investments – green taxation.

Fiscal consolidation – we have already seen that Kenya’s fiscal consolidation strategy is wanting and there is the need to push forward on financial oversight and regulation, and the importance of comprehensive structural reforms to support green economy and growth.

The views expressed in this article are those of the author alone and not the Future Africa Forum.

The views expressed in this article are those of the author and do not necessarily reflect the views of Future Africa Forum. Future Africa Forum is a pan-African policy think-tank and policy advisory consultancy headquartered in Nairobi, Kenya.